We utilized analytics and iterative testing to simplify and improve the process of managing loan debt.

Challenge

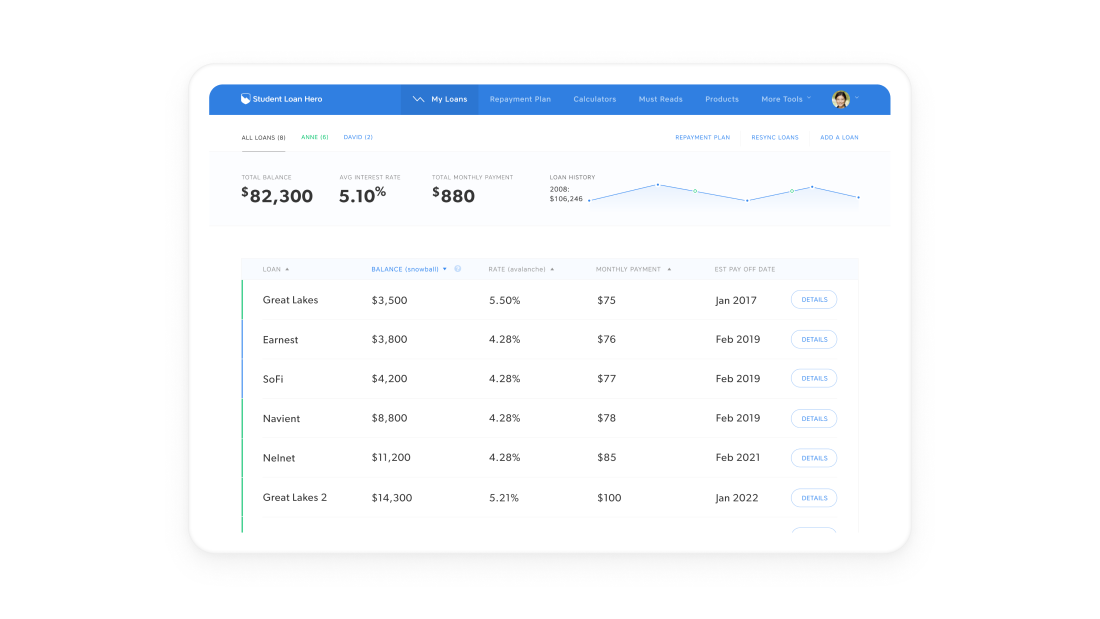

Student loans are fraught with complexity and difficult to manage as borrowers often have multiple loans with several loan providers, making repayments a frustrating experience.

Solution

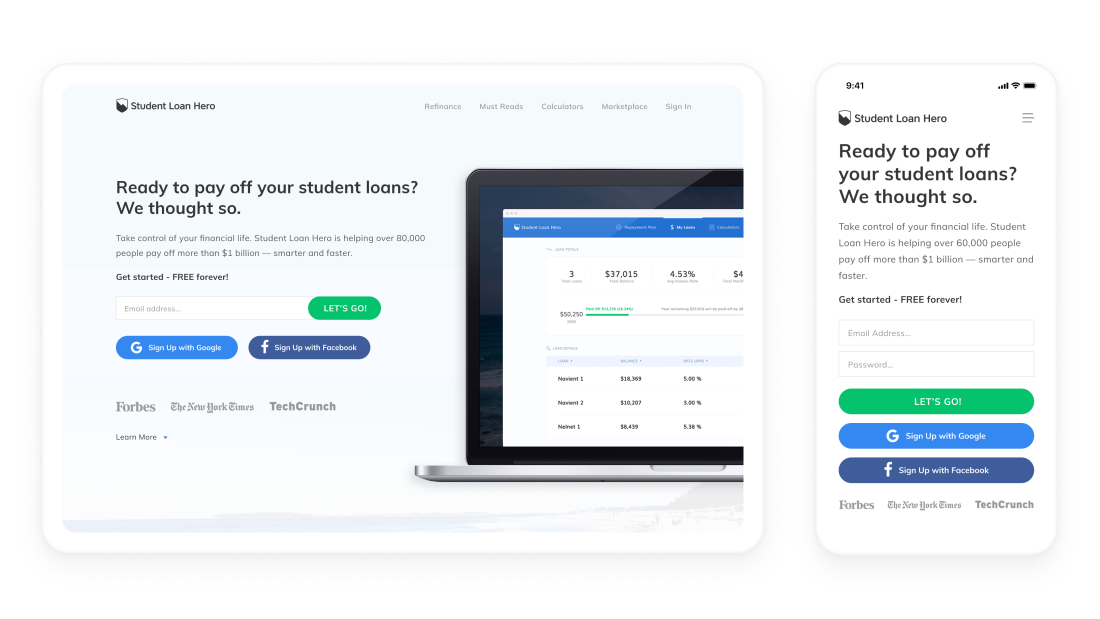

Design an easy-to-use, intuitive interface that organizes all student loans under one roof and simplifies the complexity of understanding various repayment options.

webuild has truly shined as a fully-integrated design partner; accepting our design challenges with excitement and curiosity. They come equipped with a rare ability to both sketch the big picture, and drag the minutiae to the finish line. I couldn't have found a better team!

Andrew Josuweit

CEO/Co-Founder, Student Loan Hero

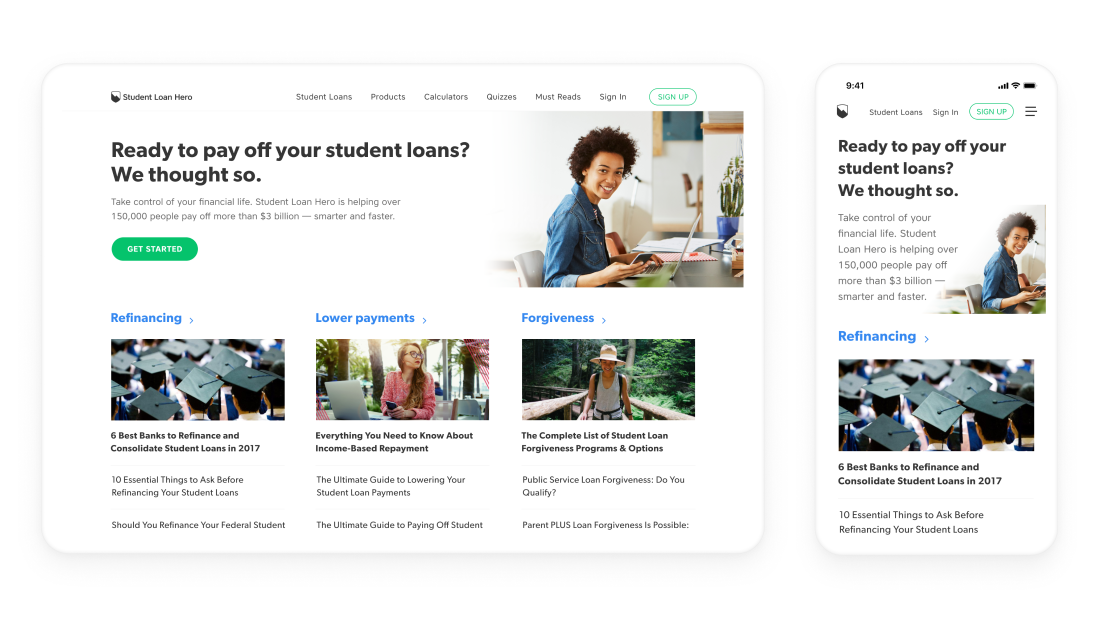

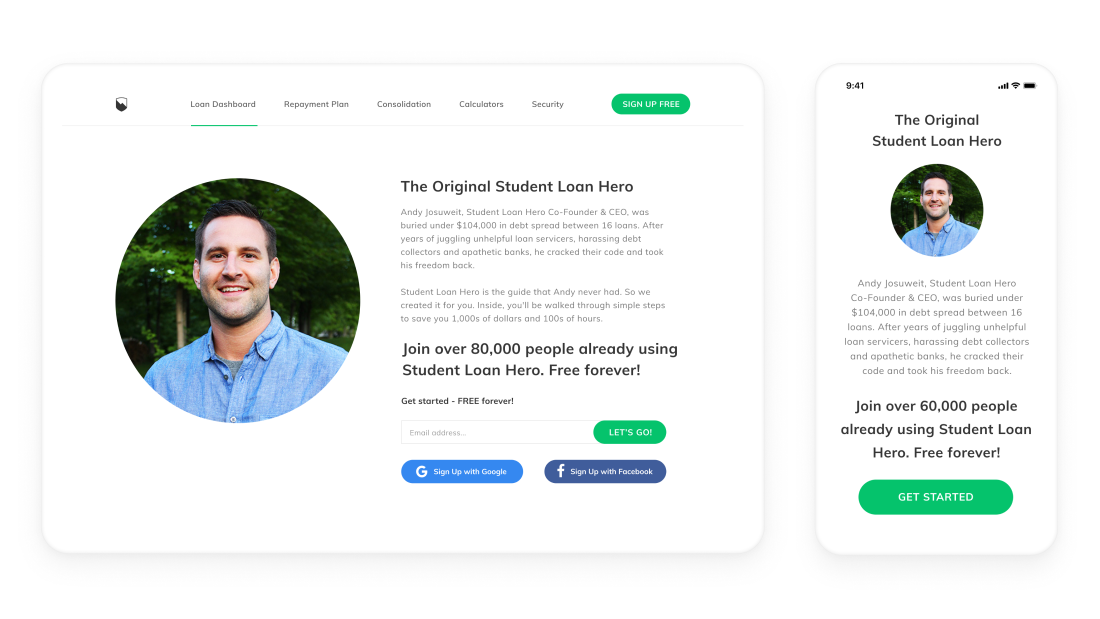

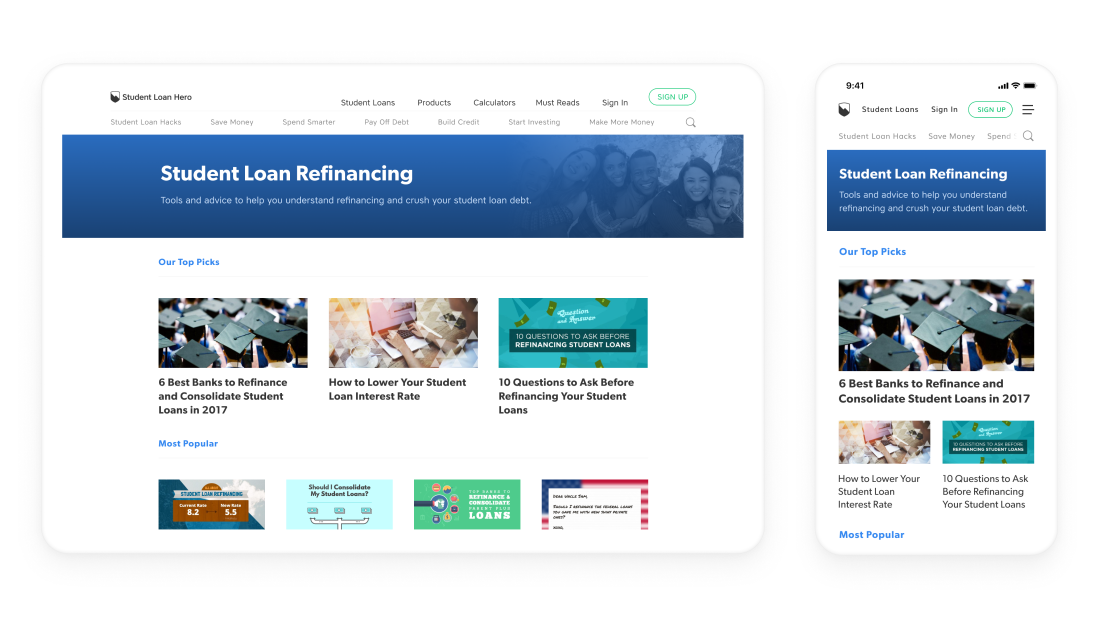

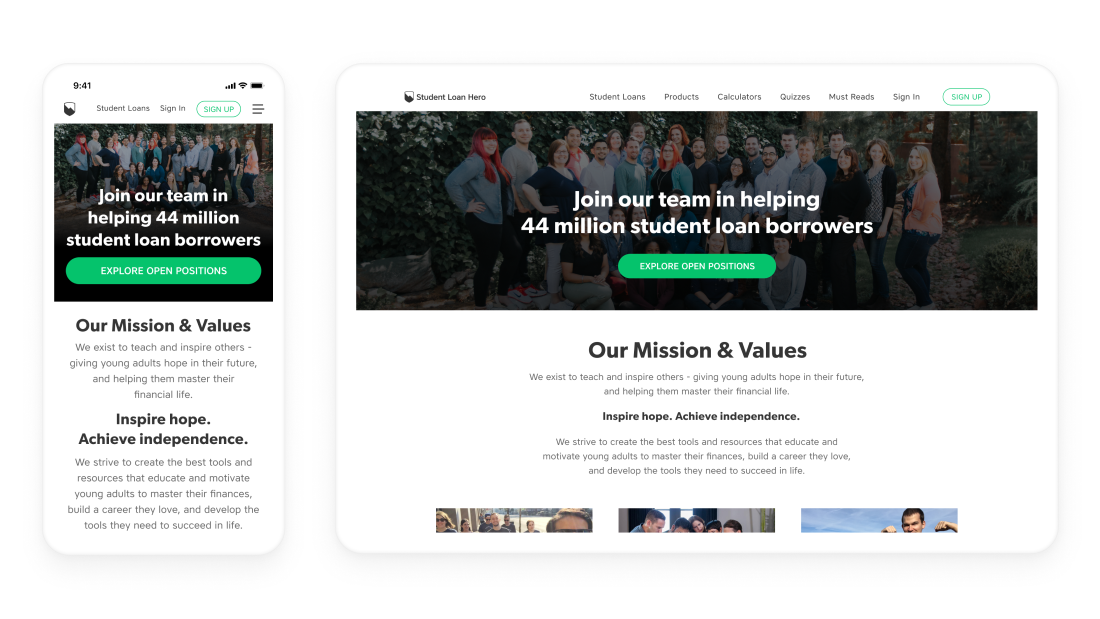

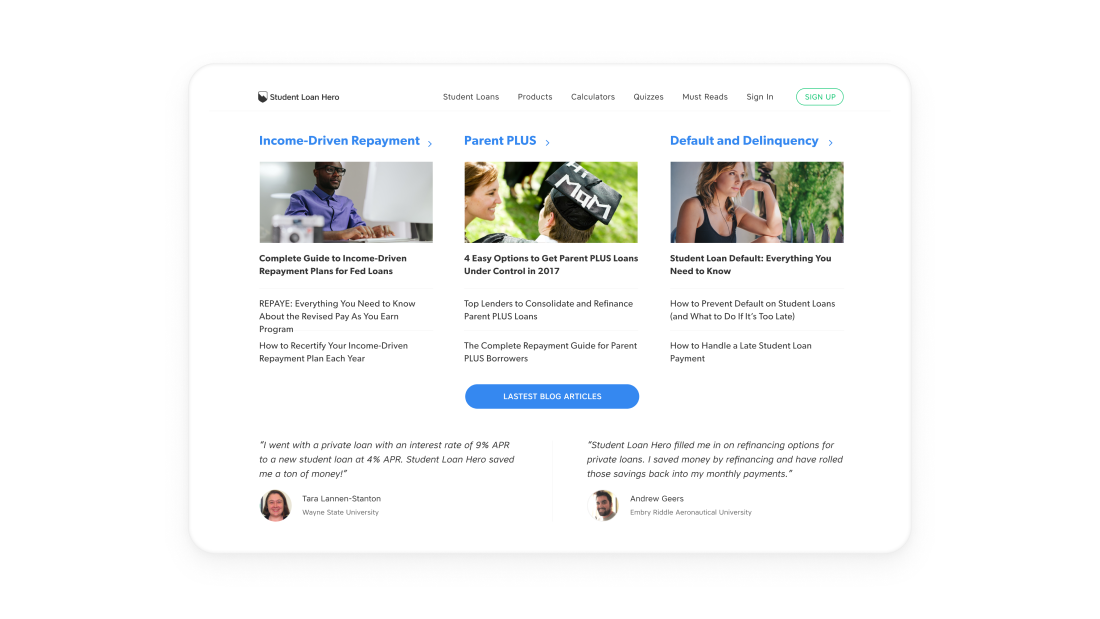

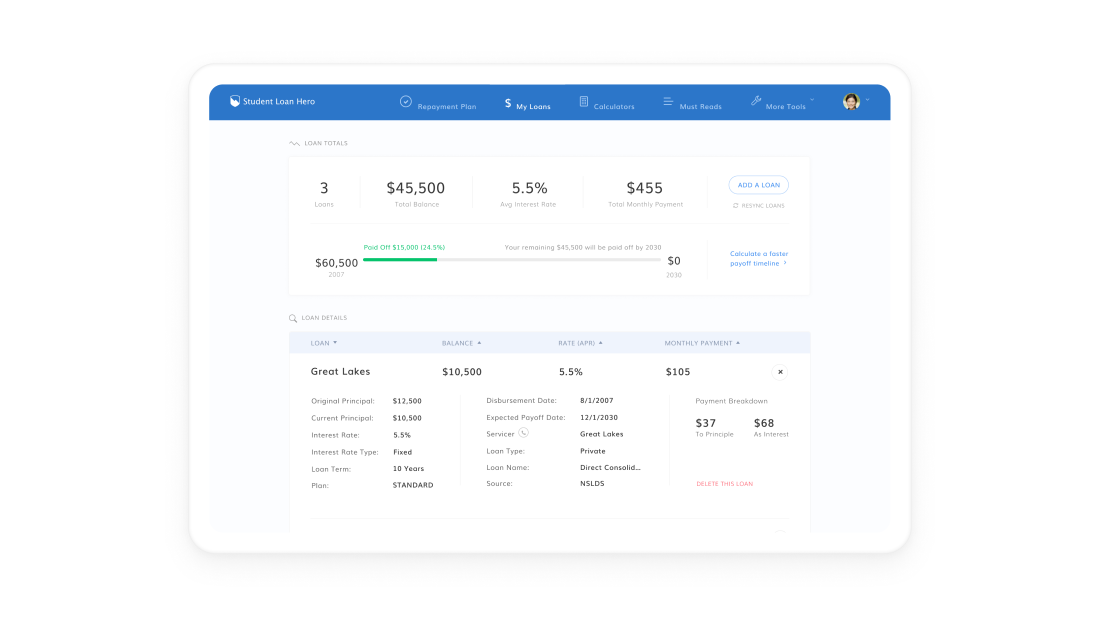

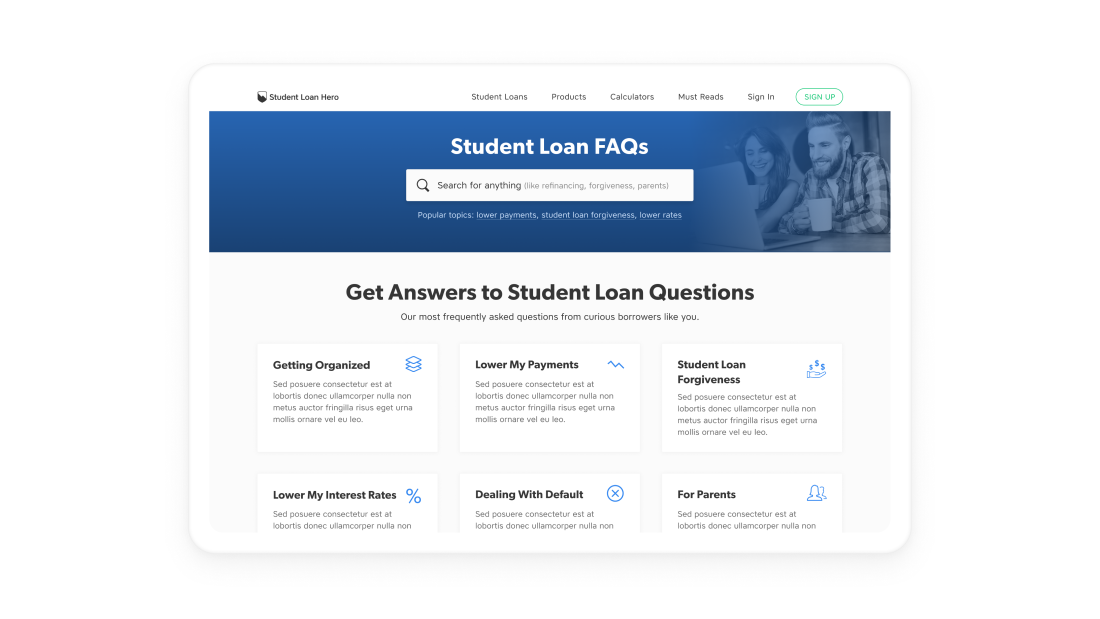

A Product Every Student Needs

Andy Josuweit, the Founder and CEO of Student Loan Hero (SLH), graduated from college and like many US students, had an enormous amount of debt amounting to over $100,000 at the time of his graduation. Overwhelmed by 12 different loans from 4 different loan servicers, Andy set out to make it easier for students (and himself) to understand and manage their multitude of loans. Student Loan Hero started as a student loan dashboard and evolved into an educational library that contained relevant topics for students and distilled important ideas into bite sized pieces of information.

Tackling America’s Student Loan Problem

Today, around 43 million Americans share over $1.5 trillion in student loan debt. As if that number isn’t scary enough, students often carry loans from many different providers, which makes the repayment process confusing and difficult to navigate.

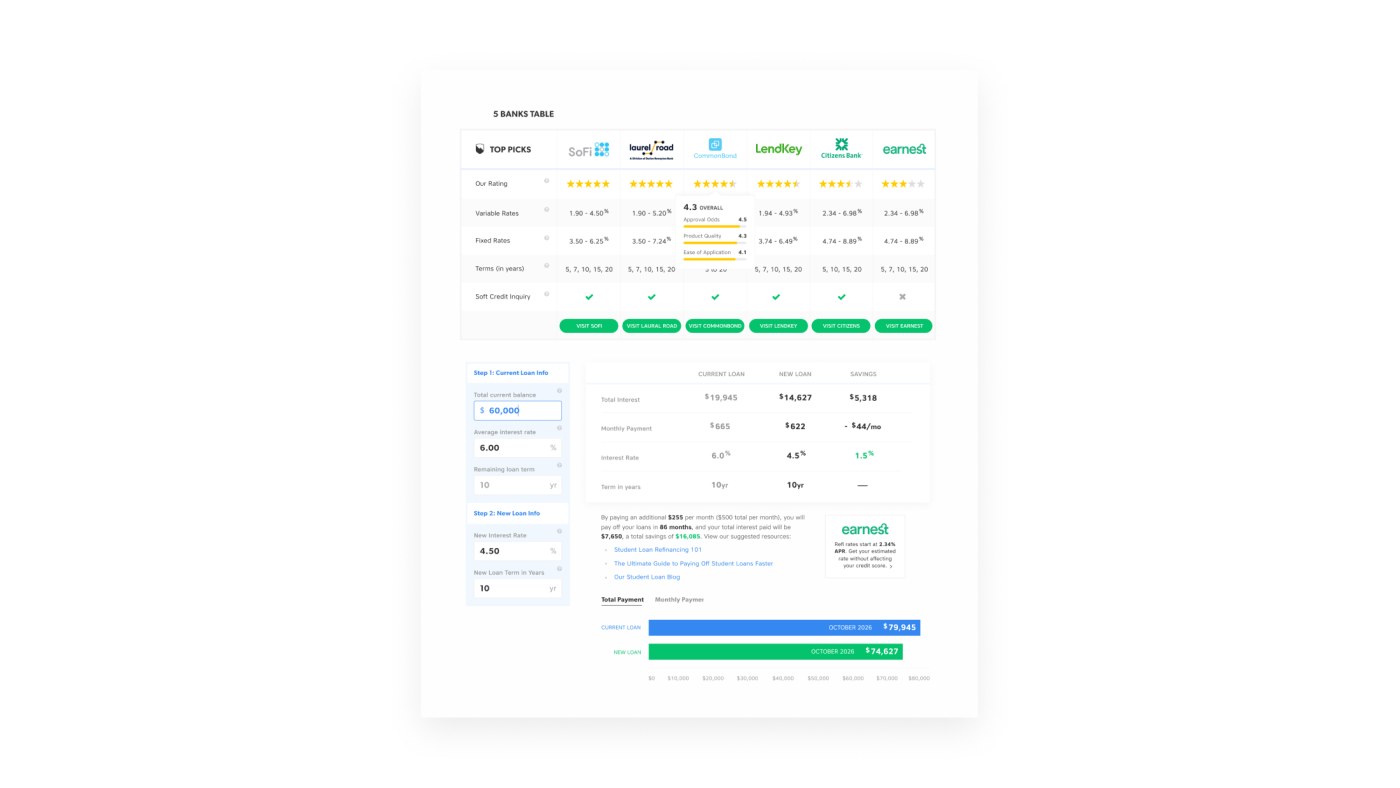

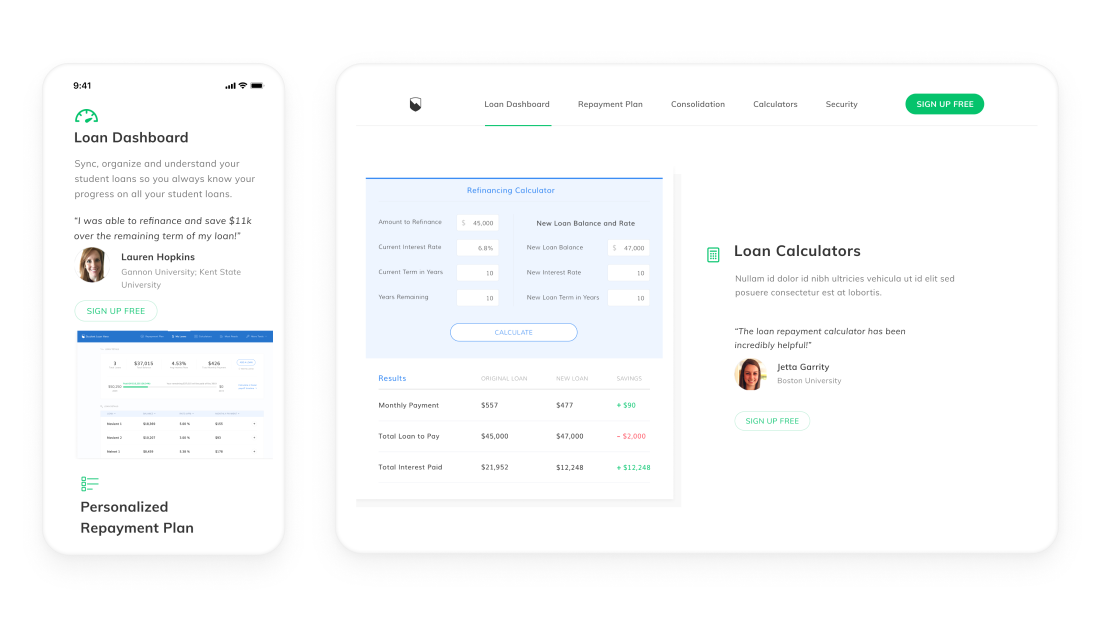

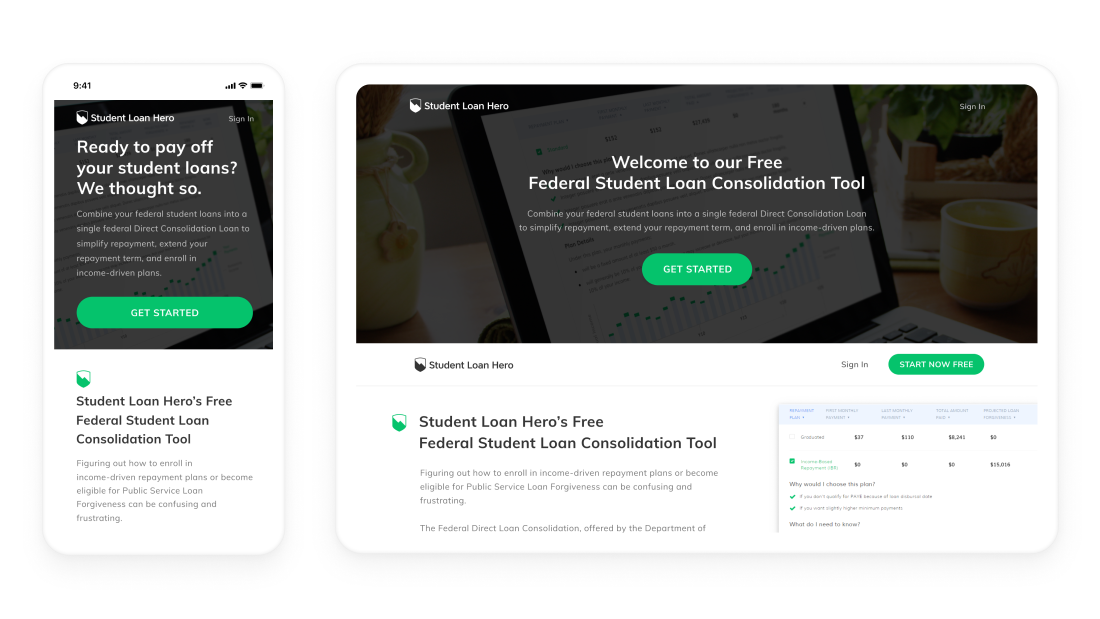

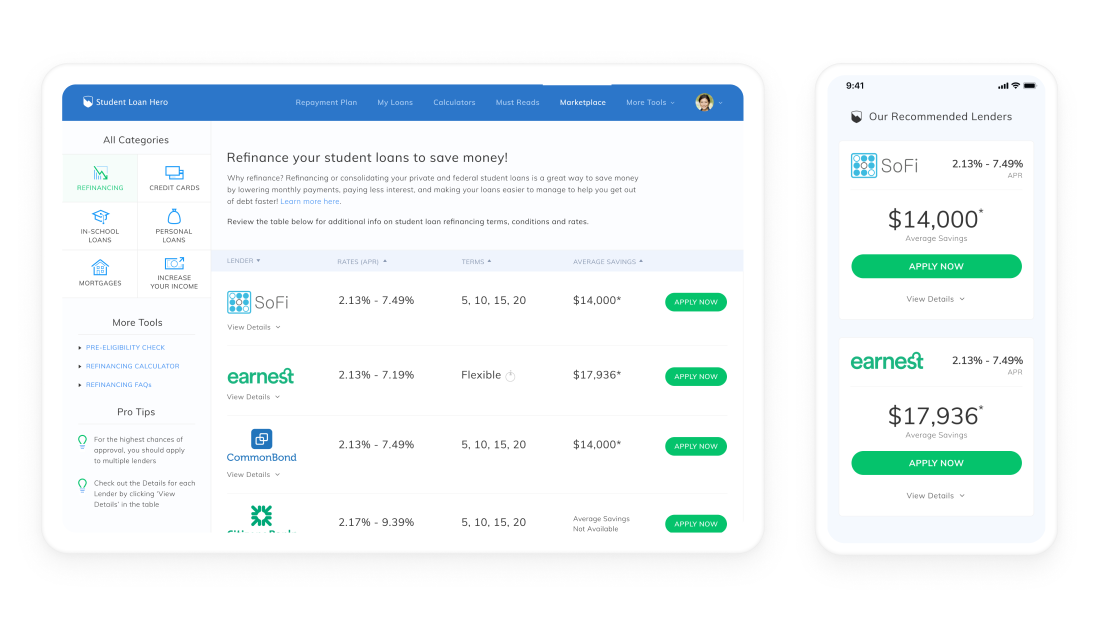

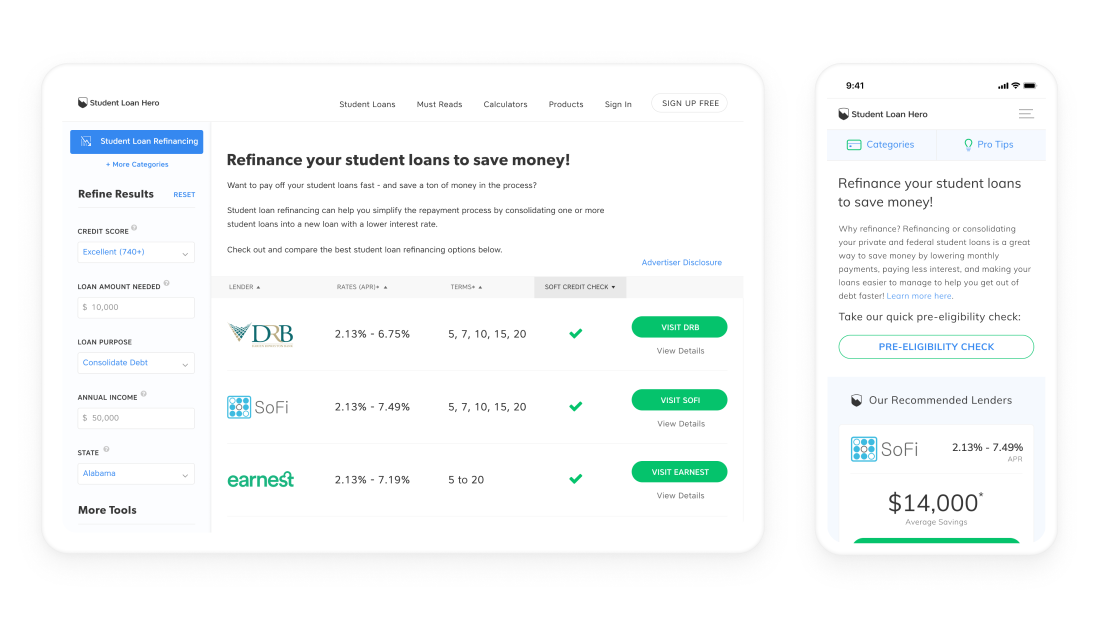

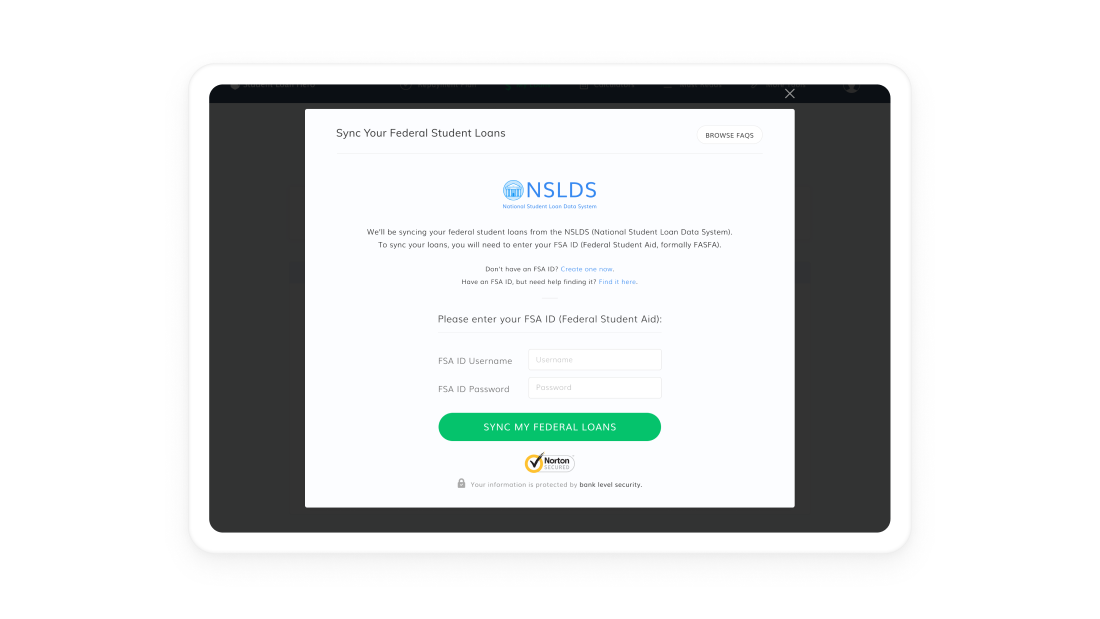

Andy envisioned a robust platform that would simplify all aspects of student loan repayment, including analysis, facilitating opportunities for payment reductions, creating custom repayment plans, and making it easy for borrowers to refinance their high-interest loans. As the first online resource to provide a single snapshot of all a student’s debt in one place, Student Loan Hero was on a mission to help students manage their loans with less hassle and provides free, financial tips when it comes to understanding a loan. That’s where we came in.

Using Design to Help Demystify Loans

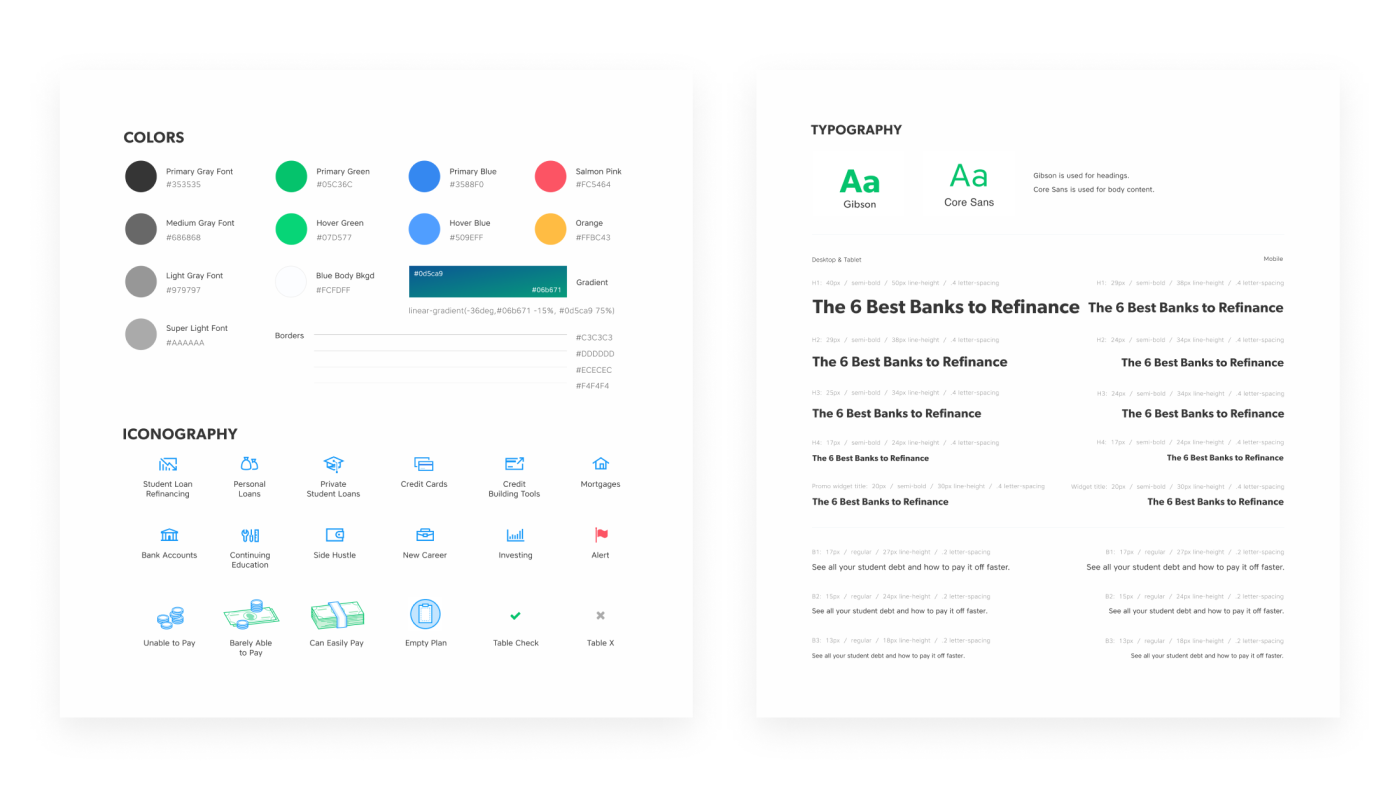

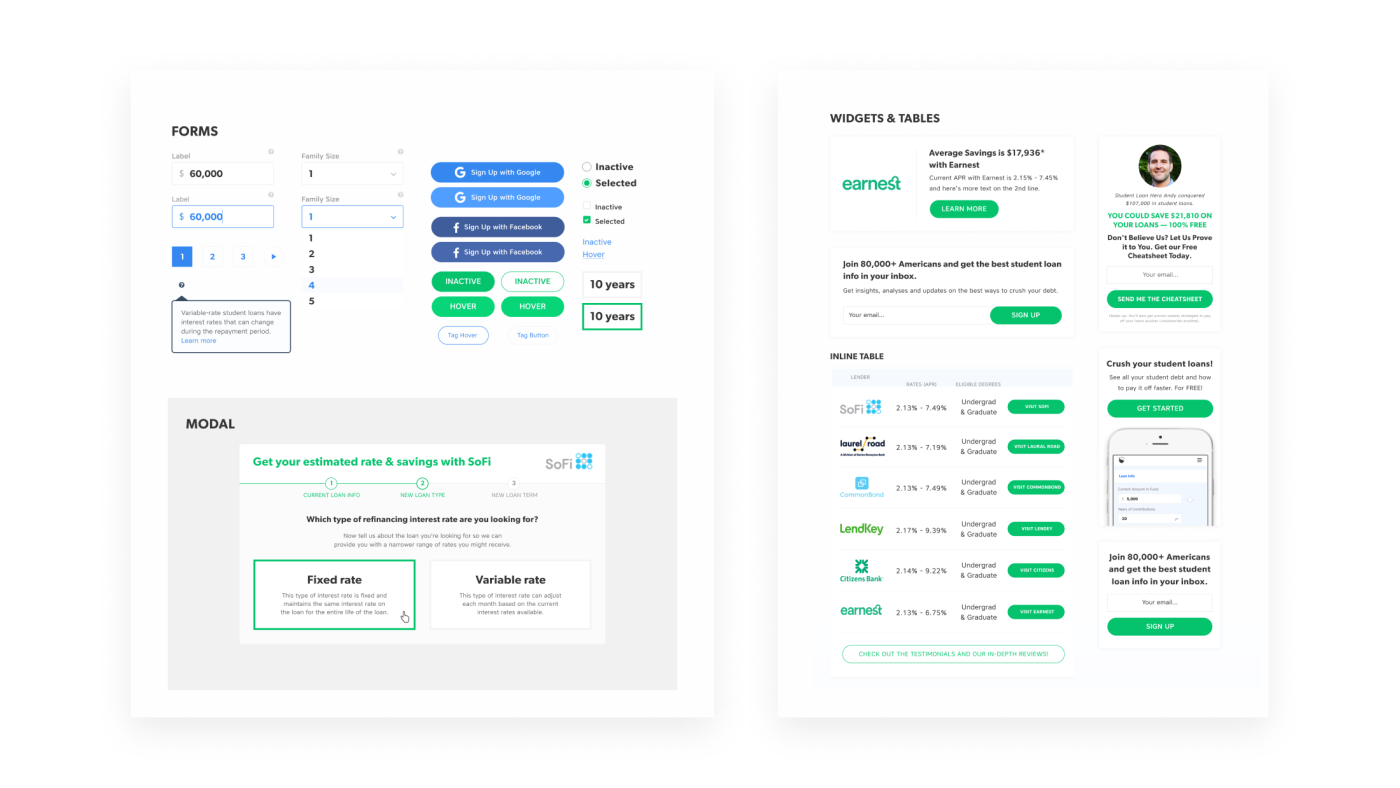

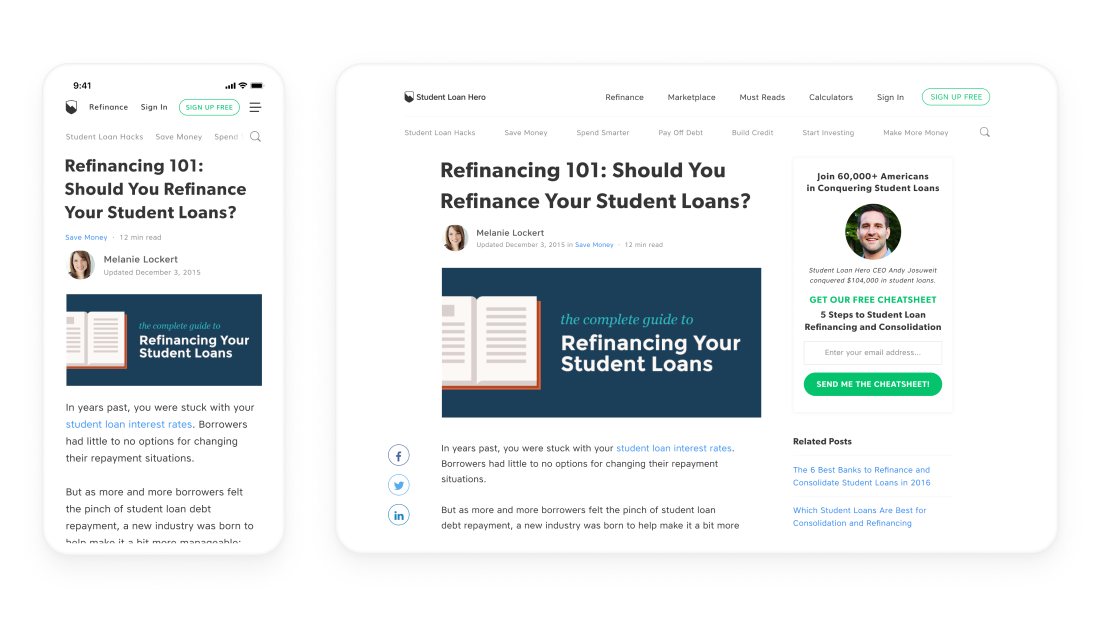

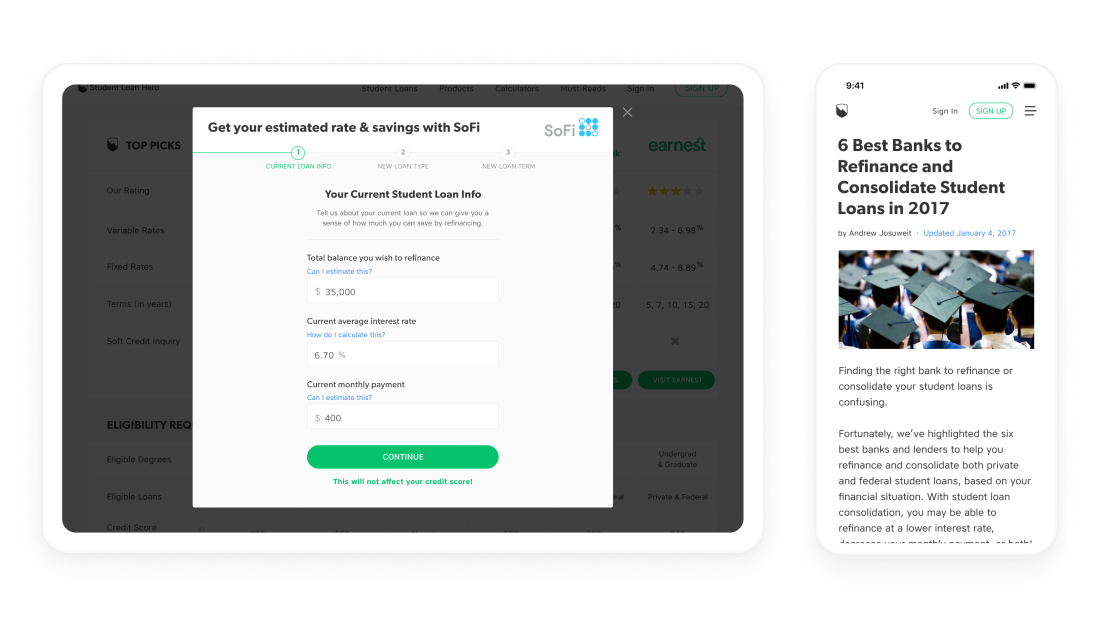

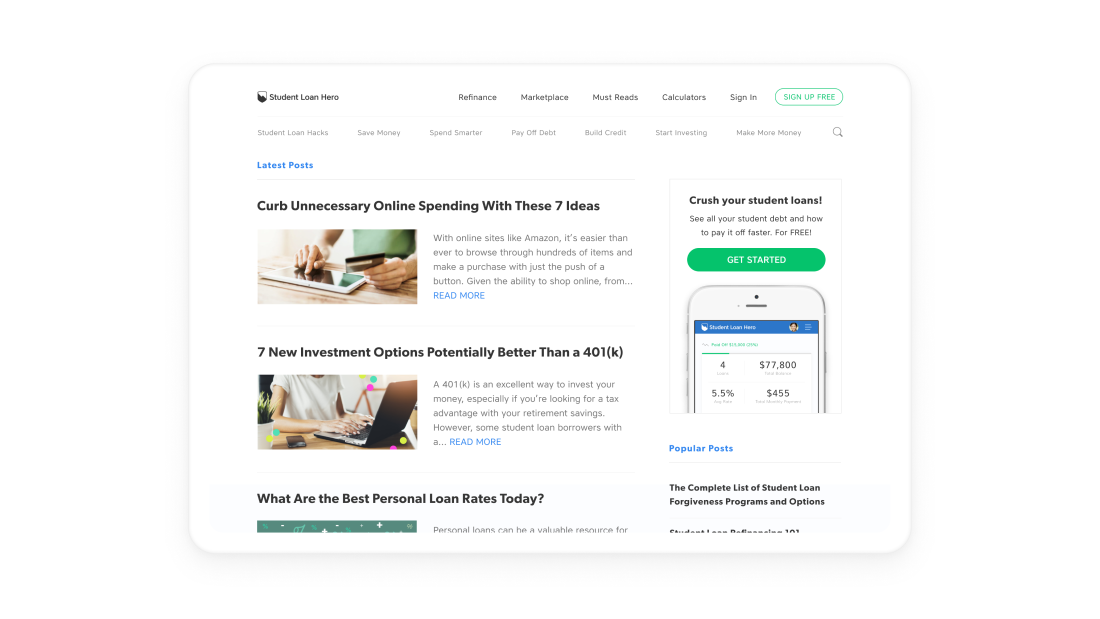

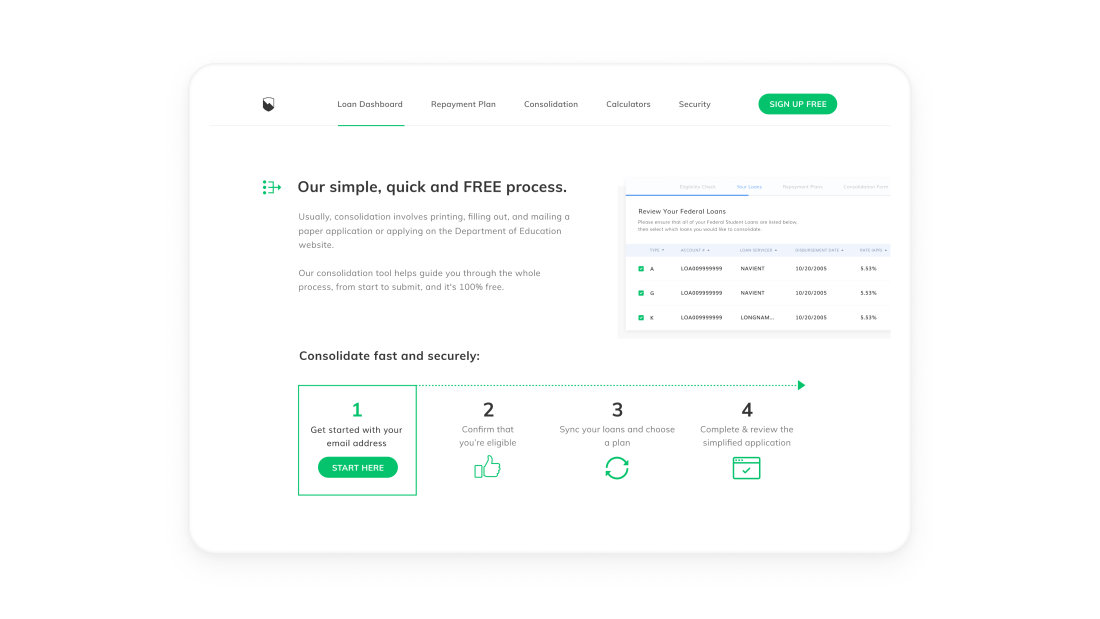

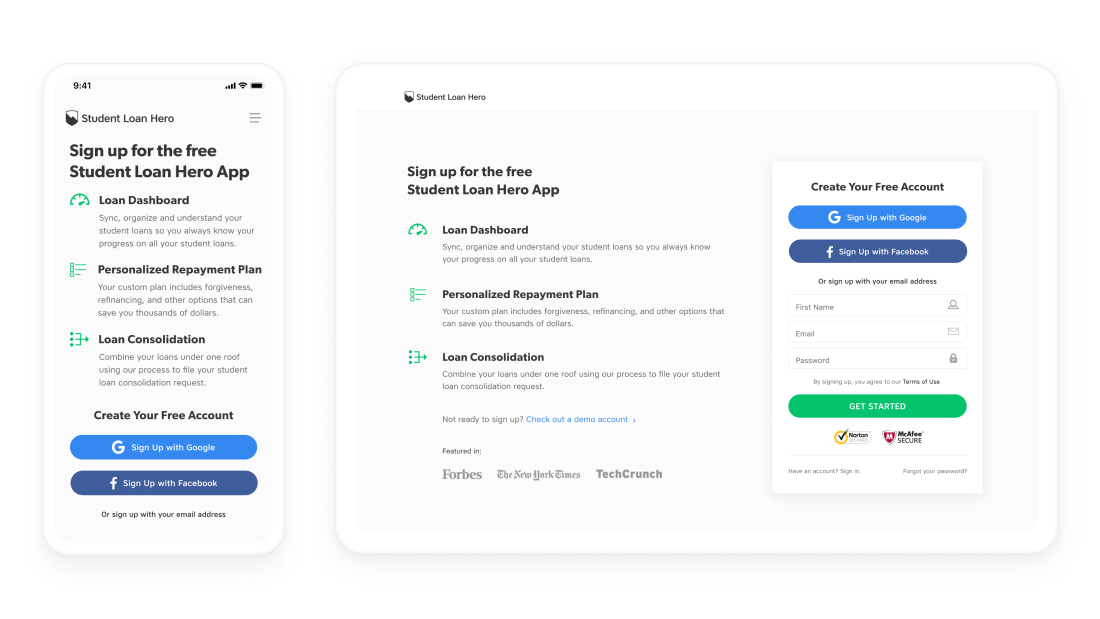

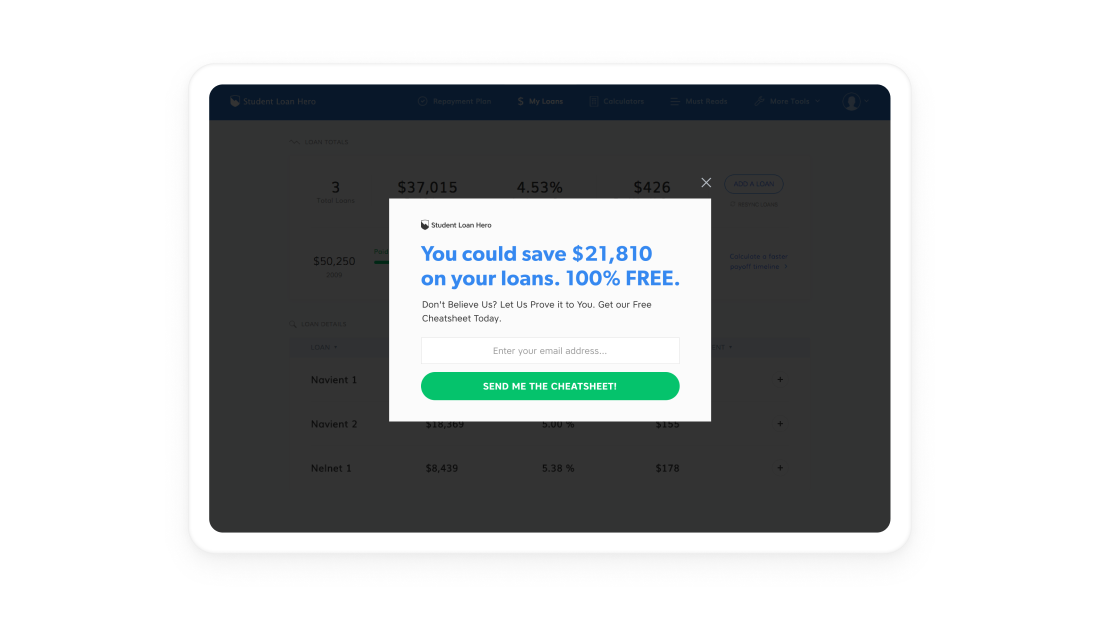

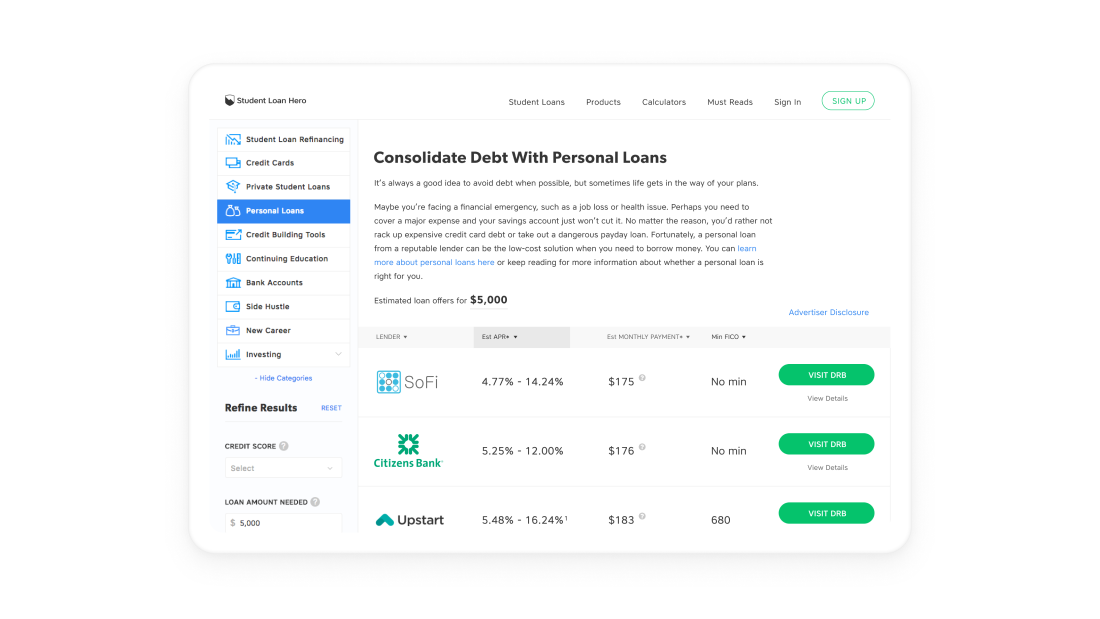

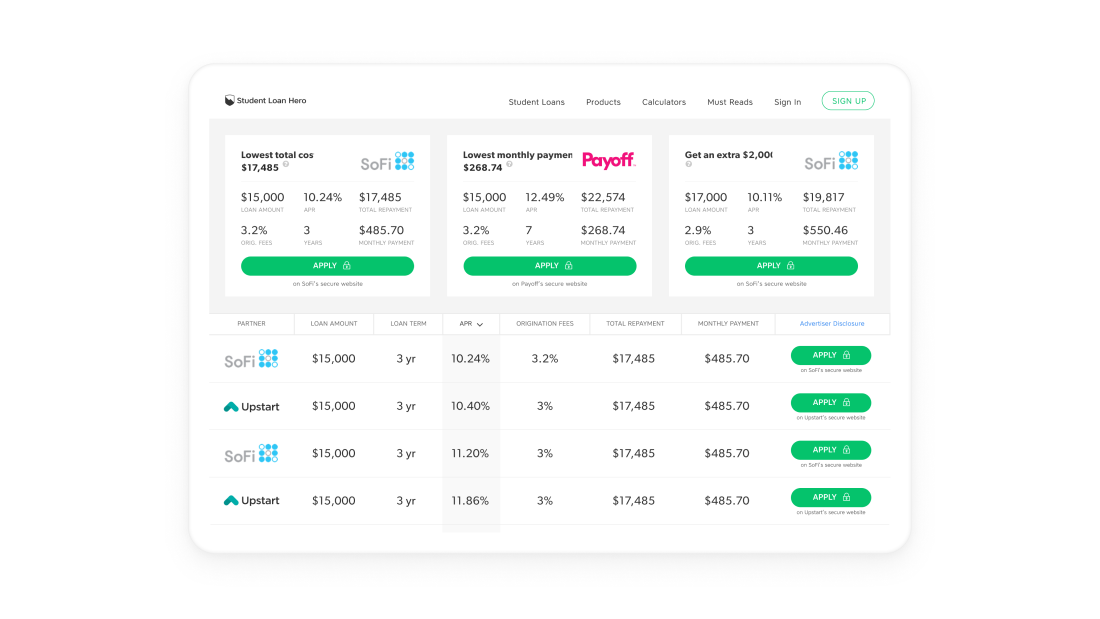

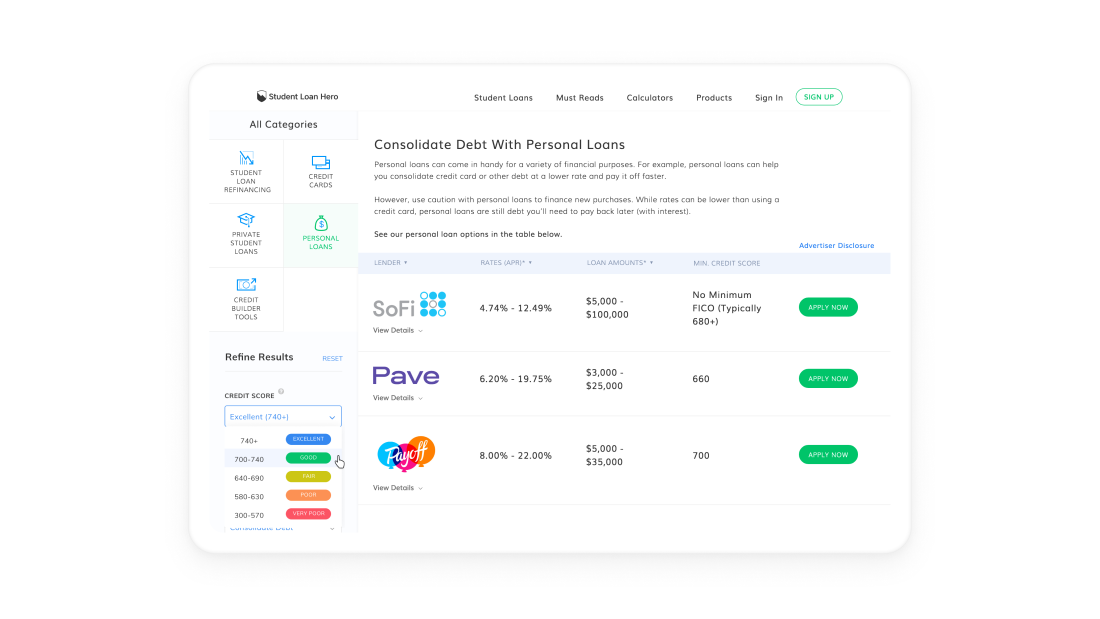

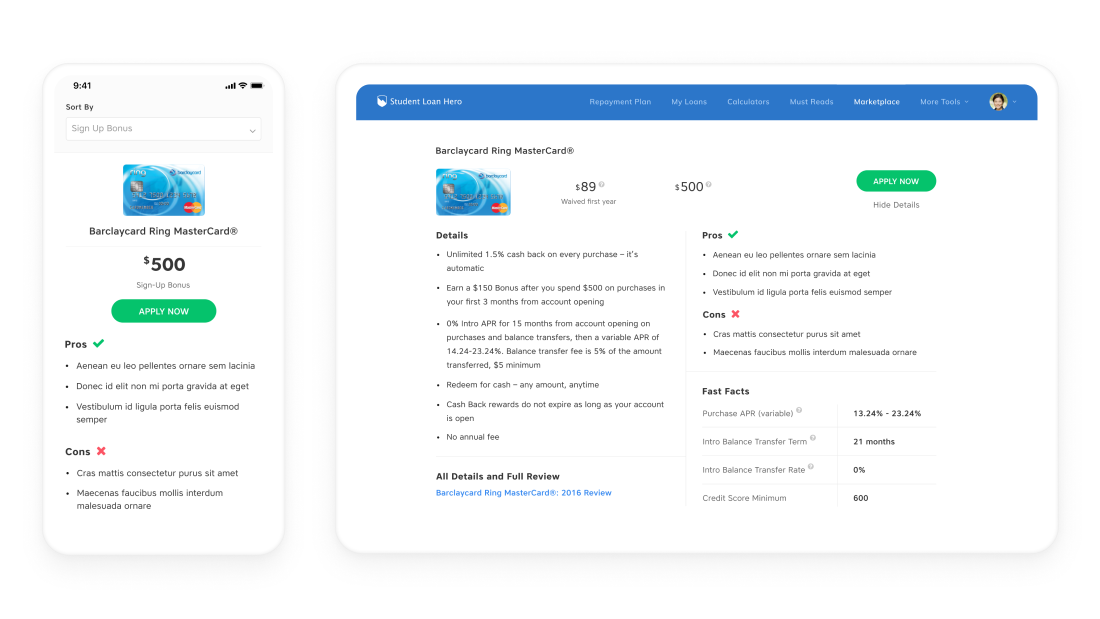

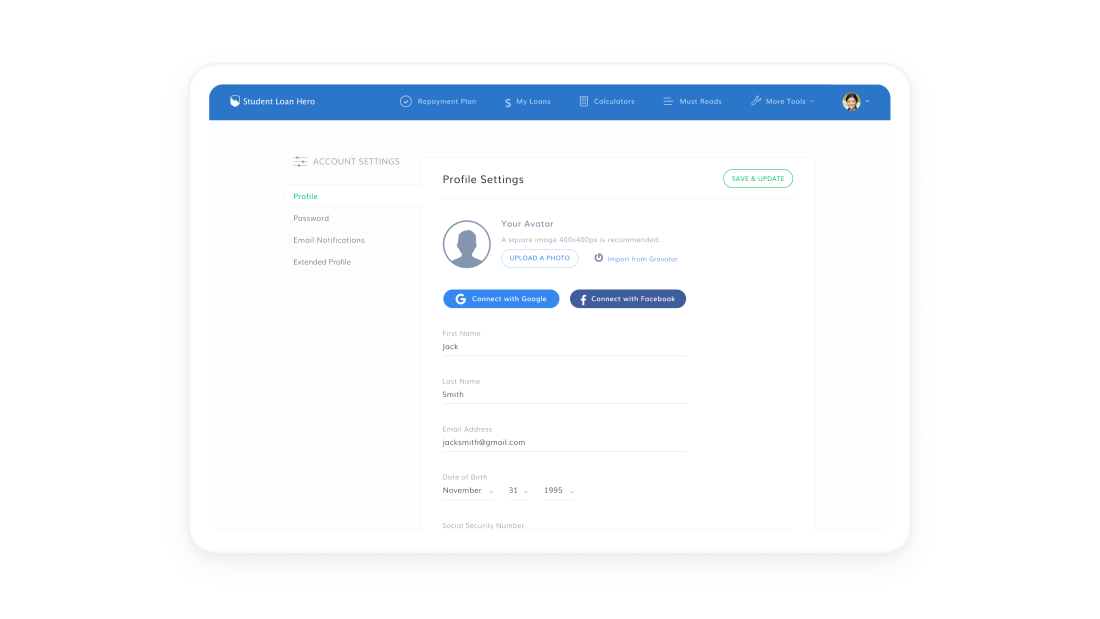

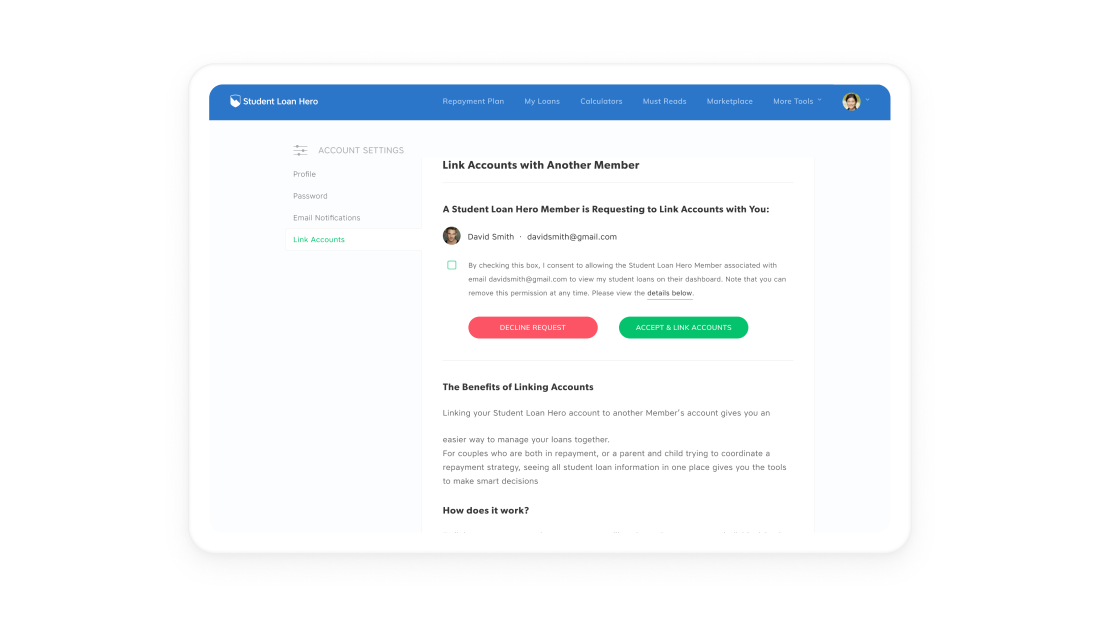

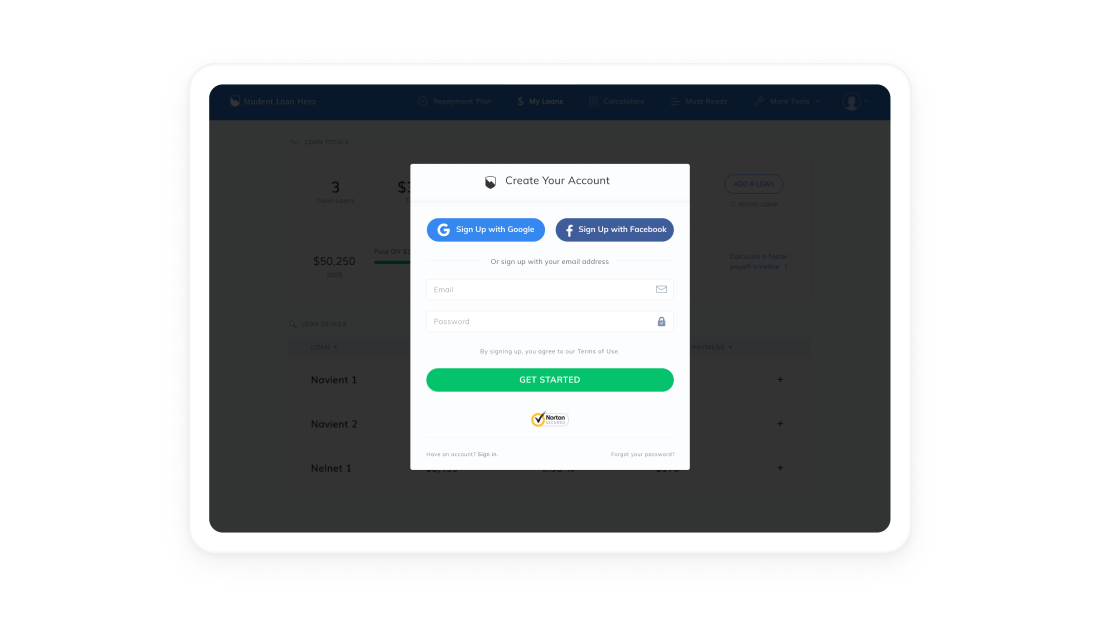

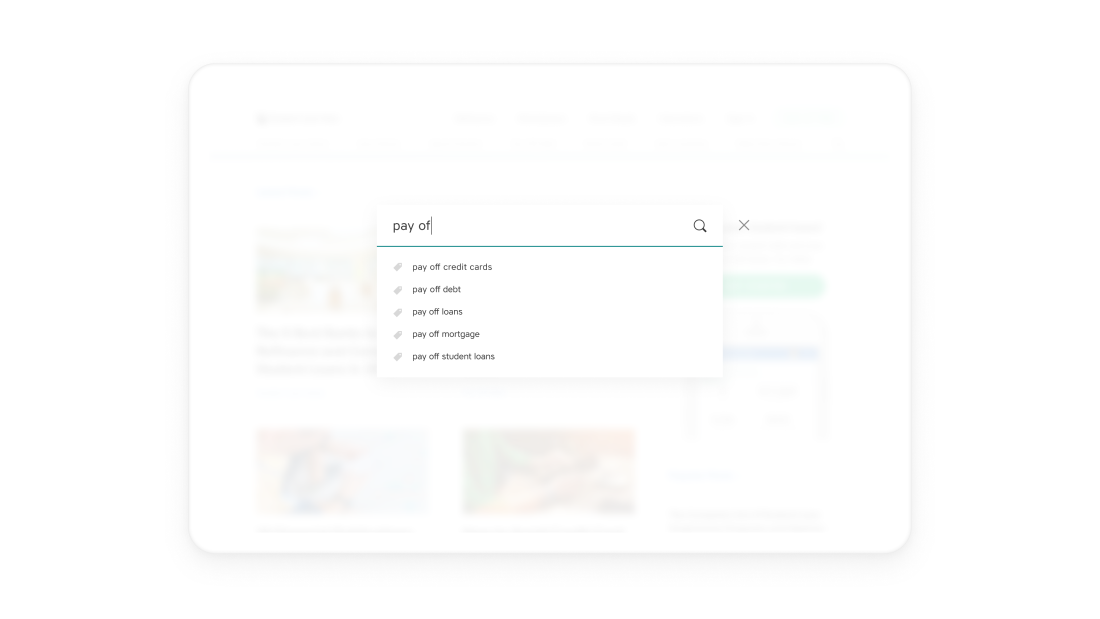

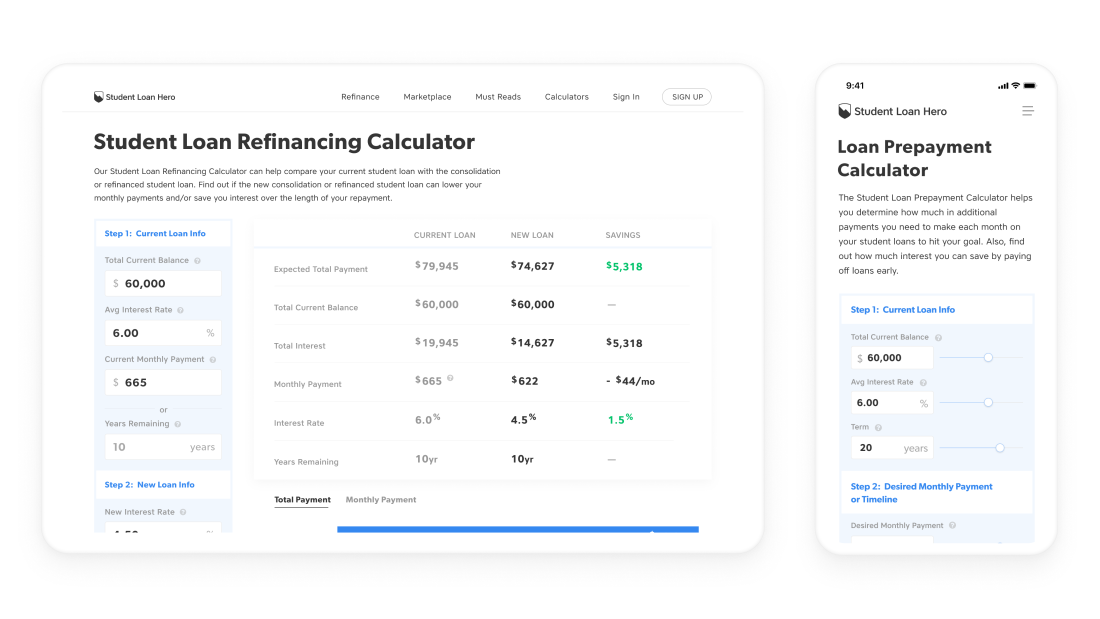

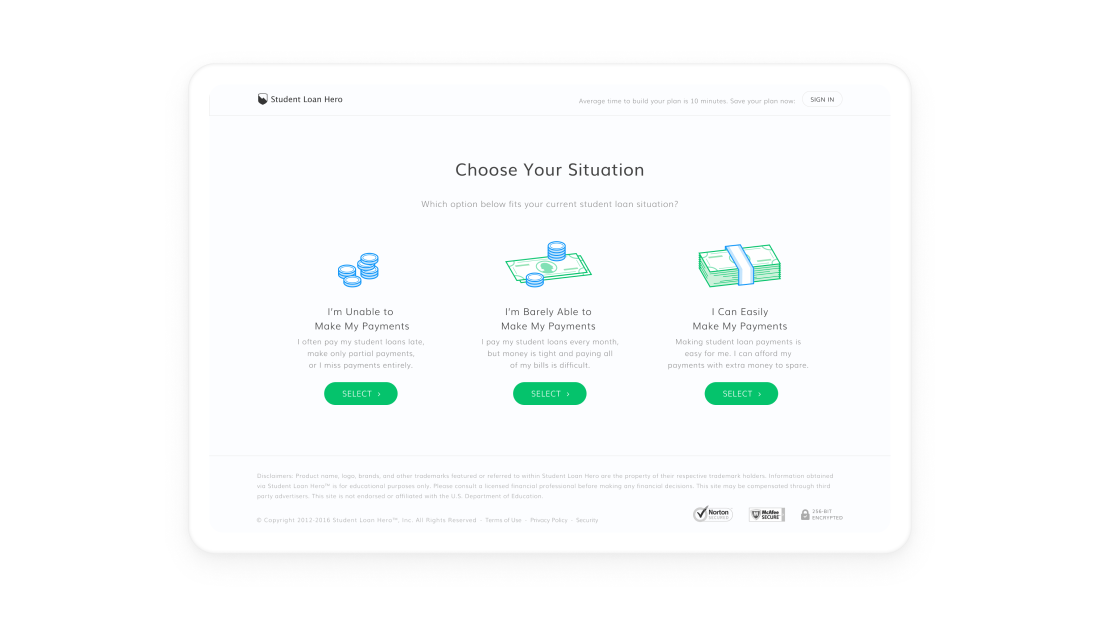

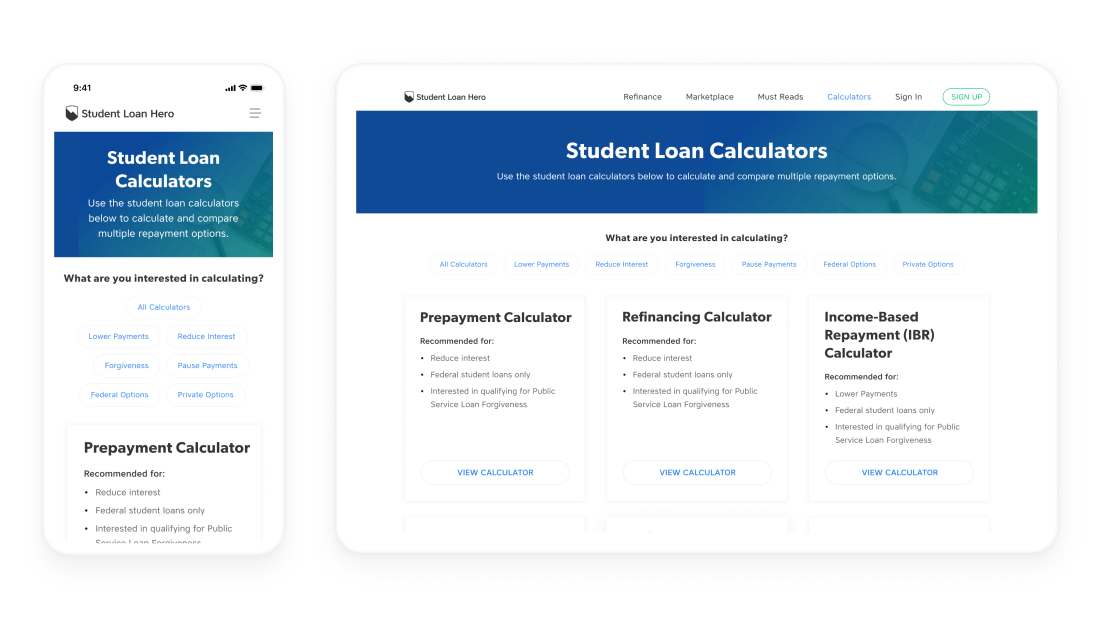

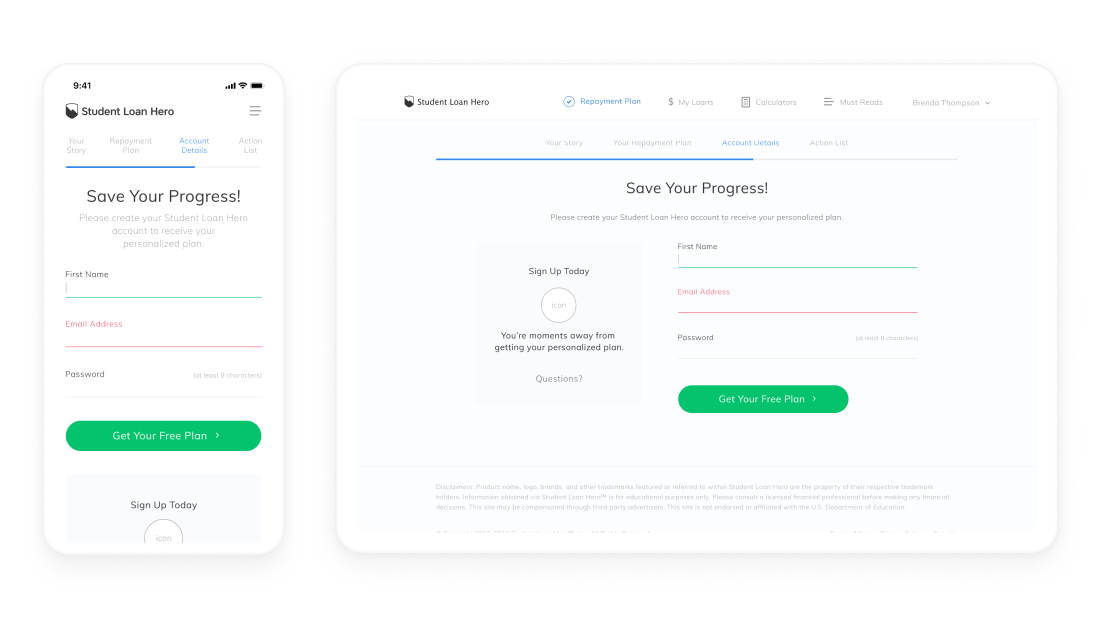

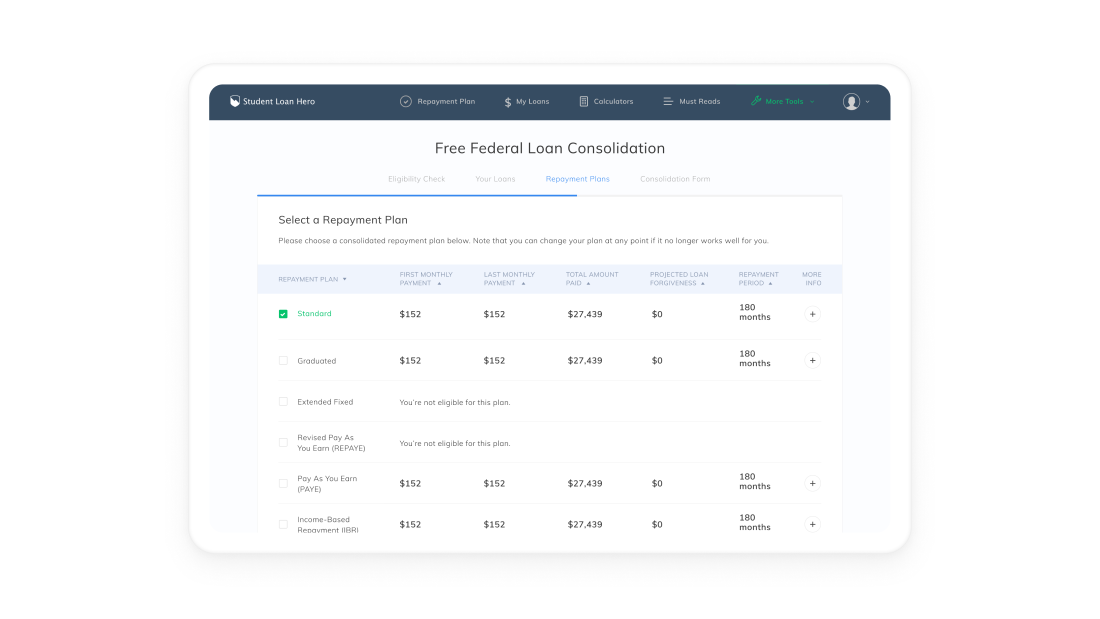

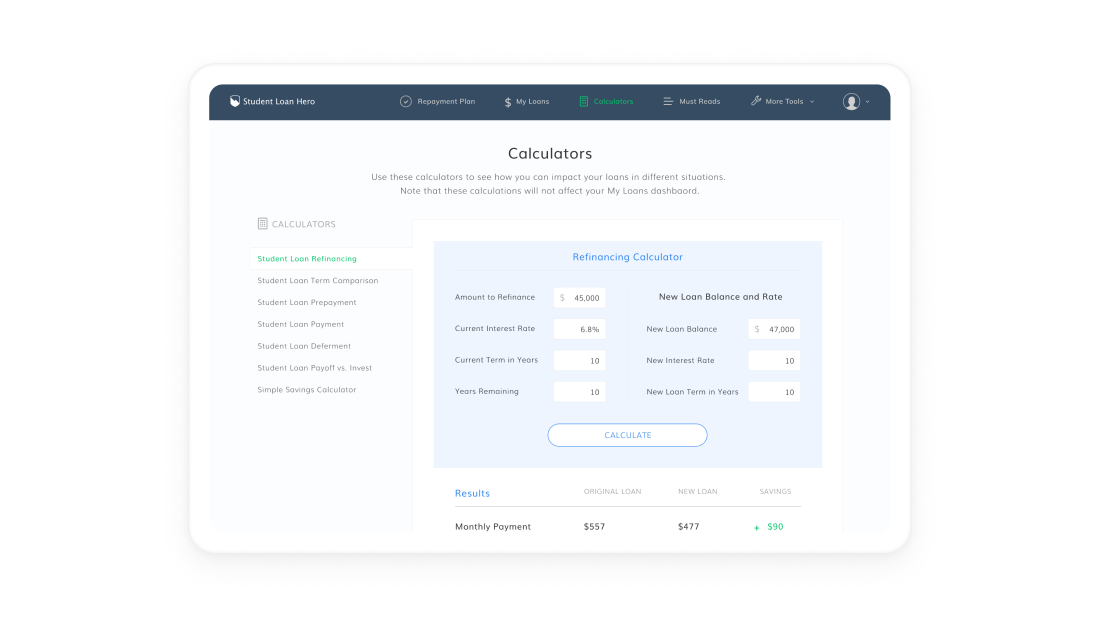

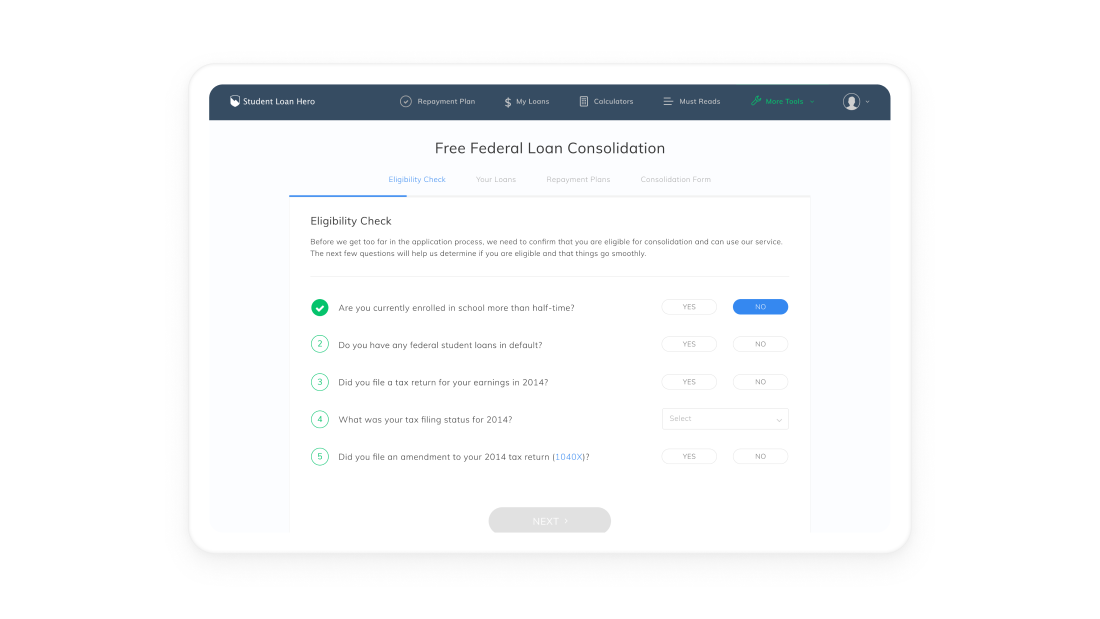

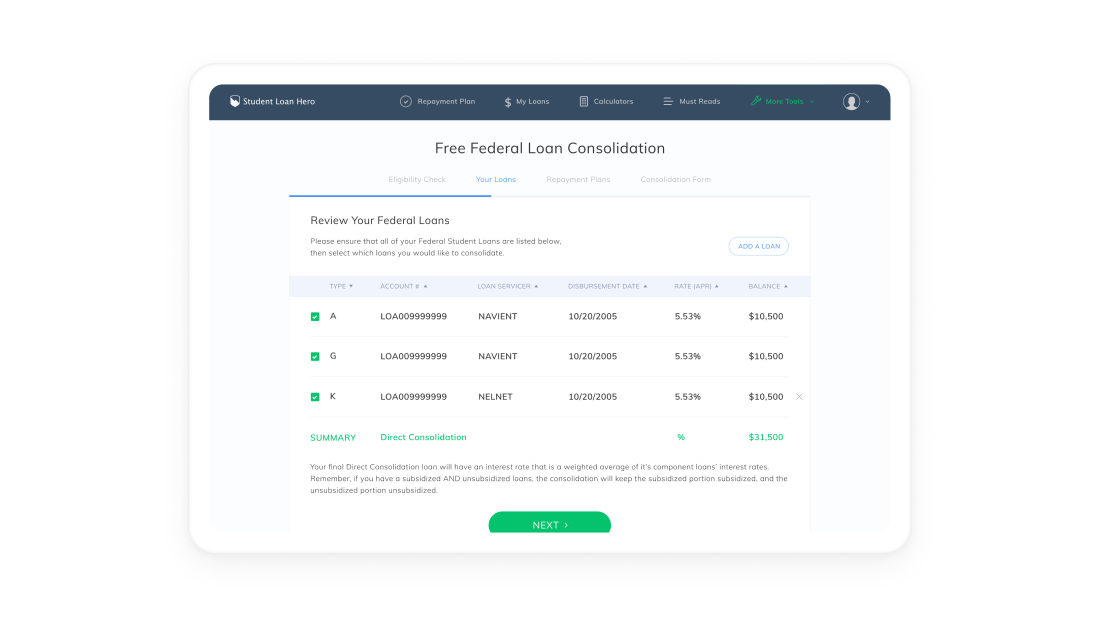

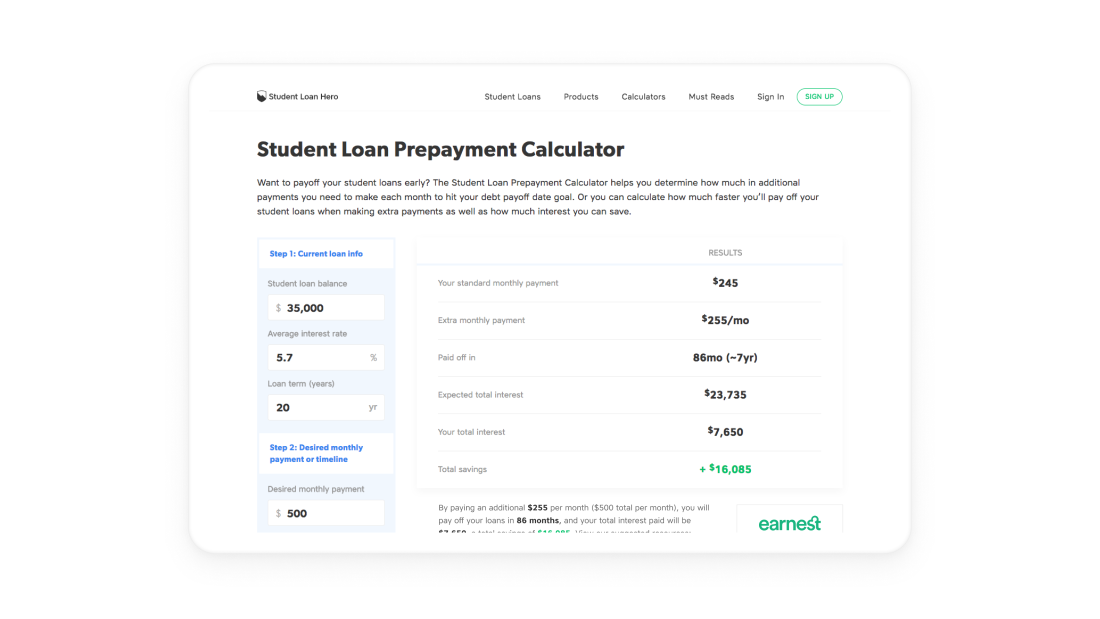

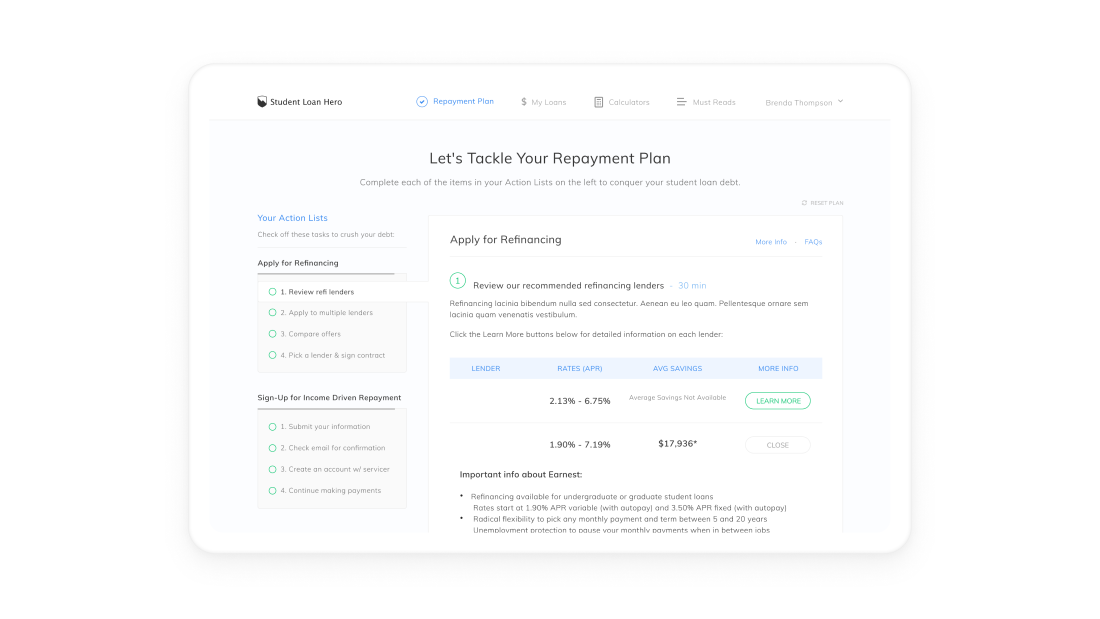

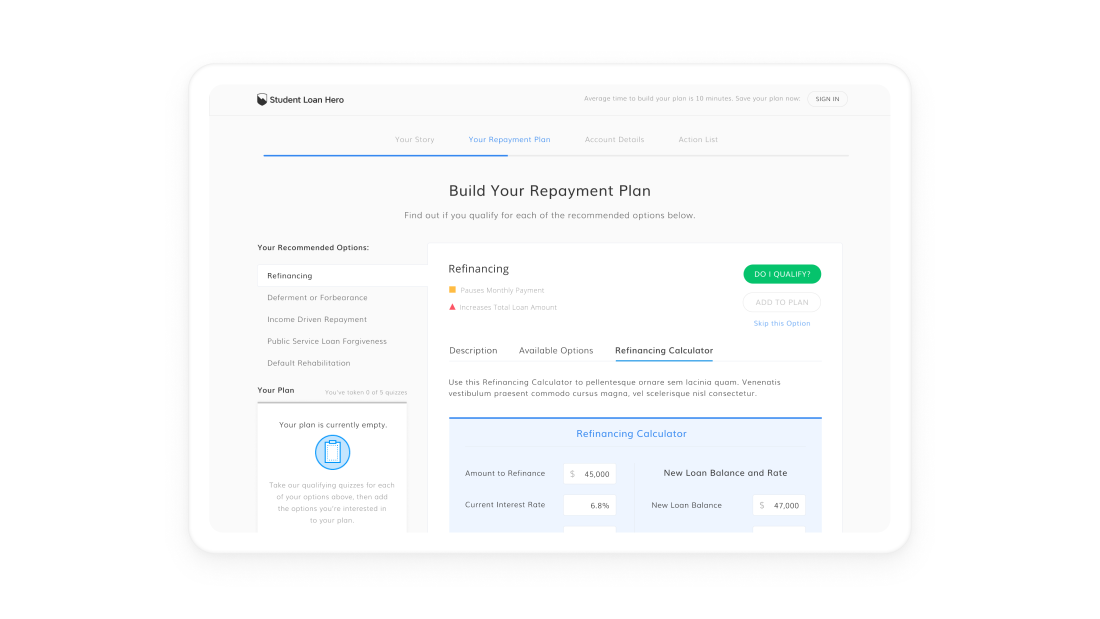

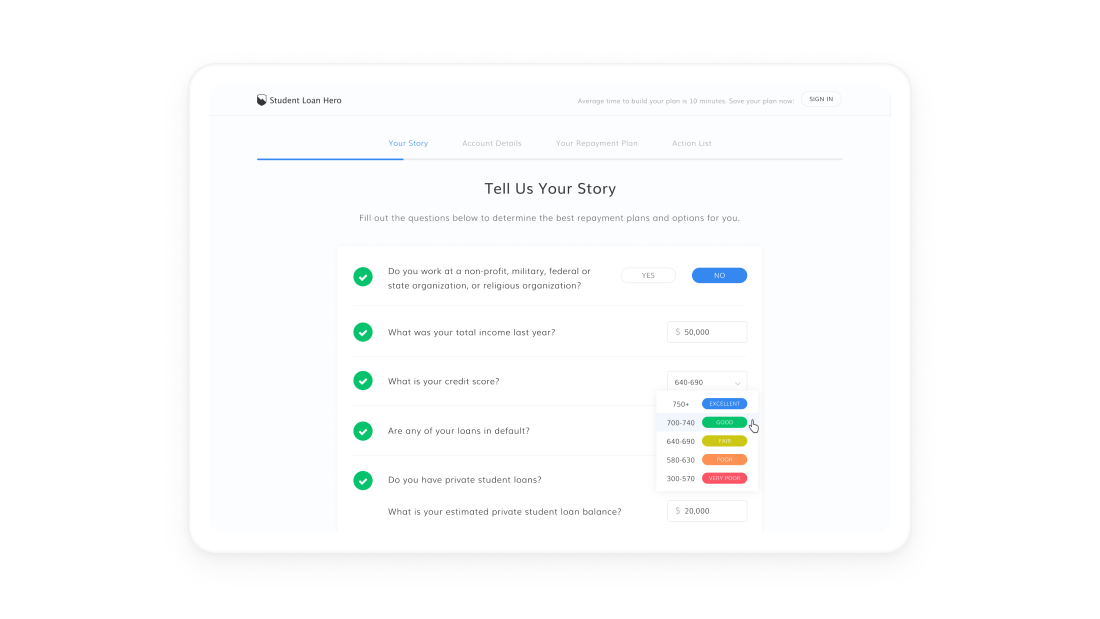

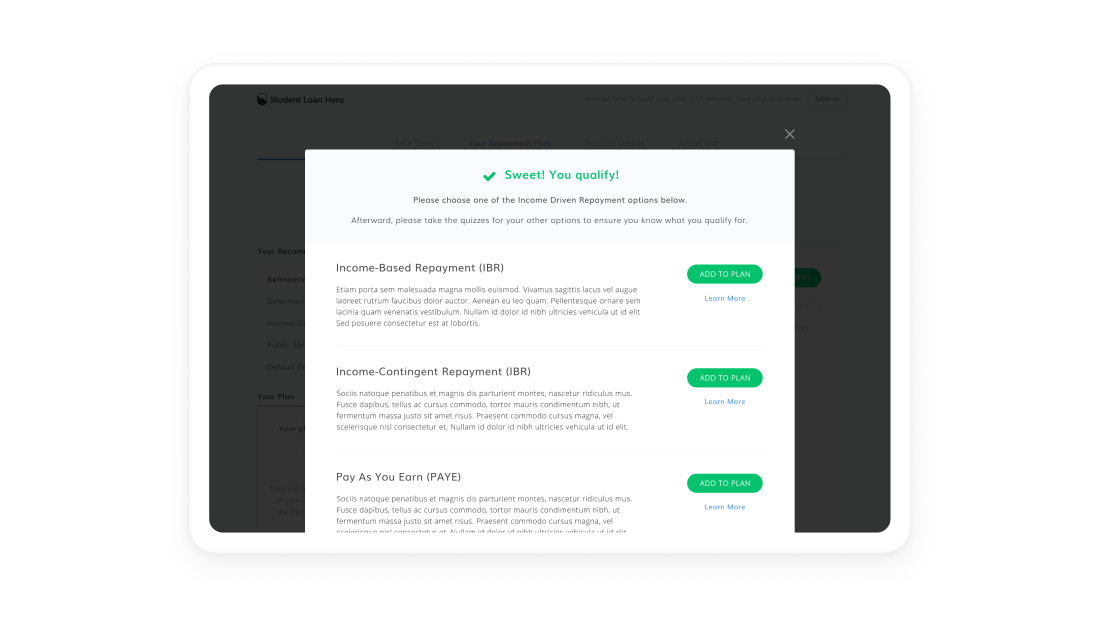

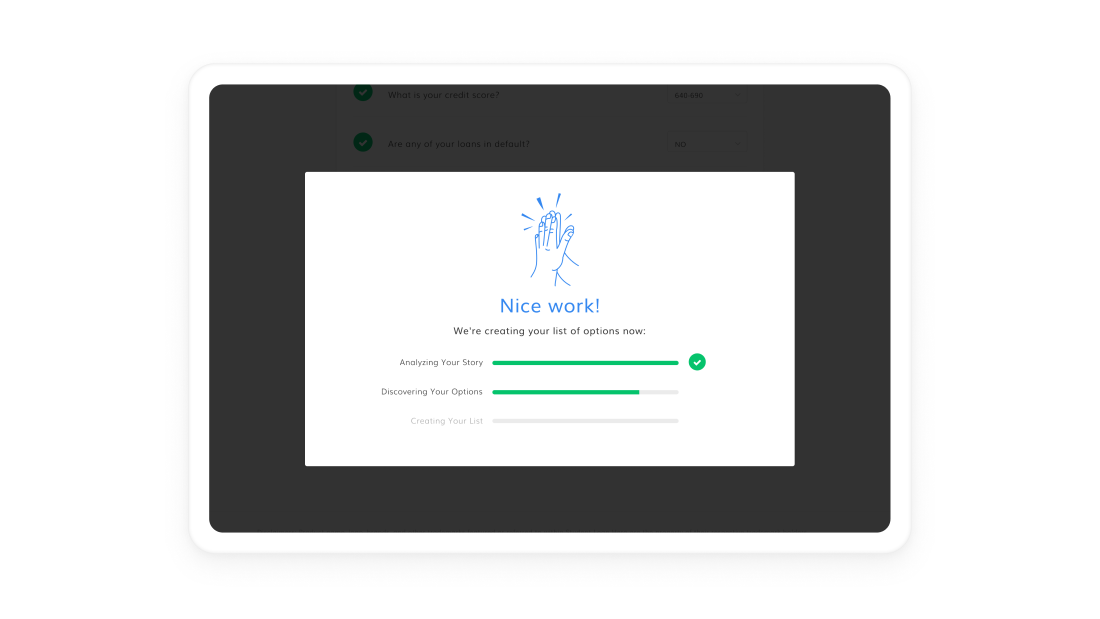

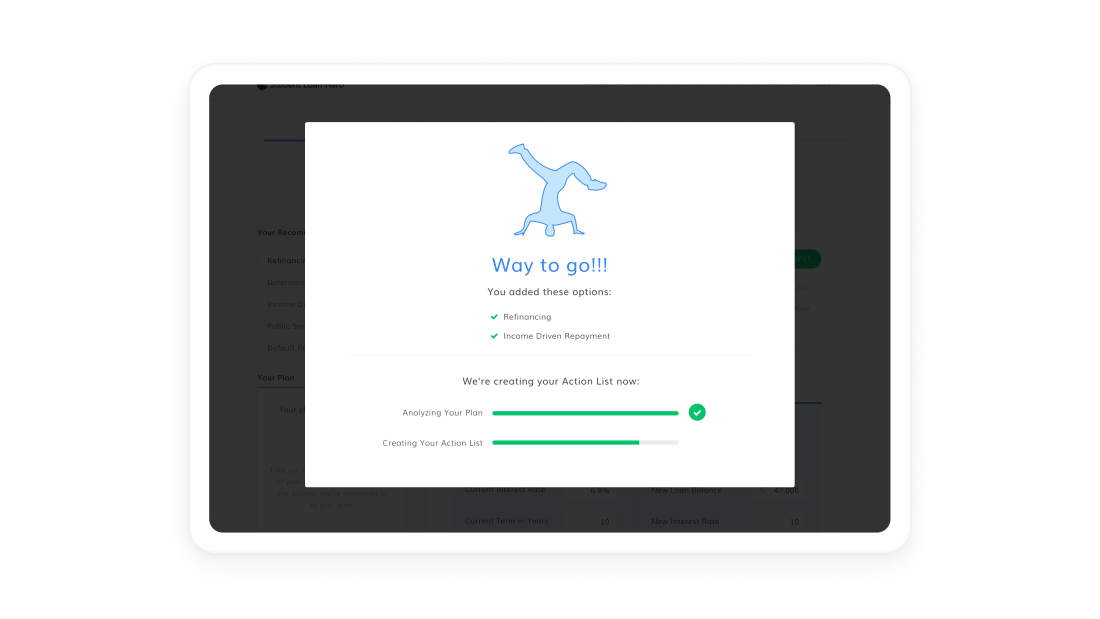

We established a style guide and designs that elevated Student Loan Hero’s brand and user experience across both the blog and dashboard. Our strategy was relentless optimization; we ran numerous A/B tests across the SLH web property, conducting over 100 tests on button copy, colors, photos, layouts, tables, etc. We constantly gathered user feedback and distilled user testing insights to further improve conversion rates. These insights led us to establish a guided tool (the Repayment Plan builder), that allowed users to sift through loan repayment options and add them to their action list and from there, provided steps on how to apply. We created new products that helped students manage filling out outdated PDFs. Through these updates, we built a community of students who are empowered to conquer their loans and manage their debt.

Relentless Optimization Drives Results

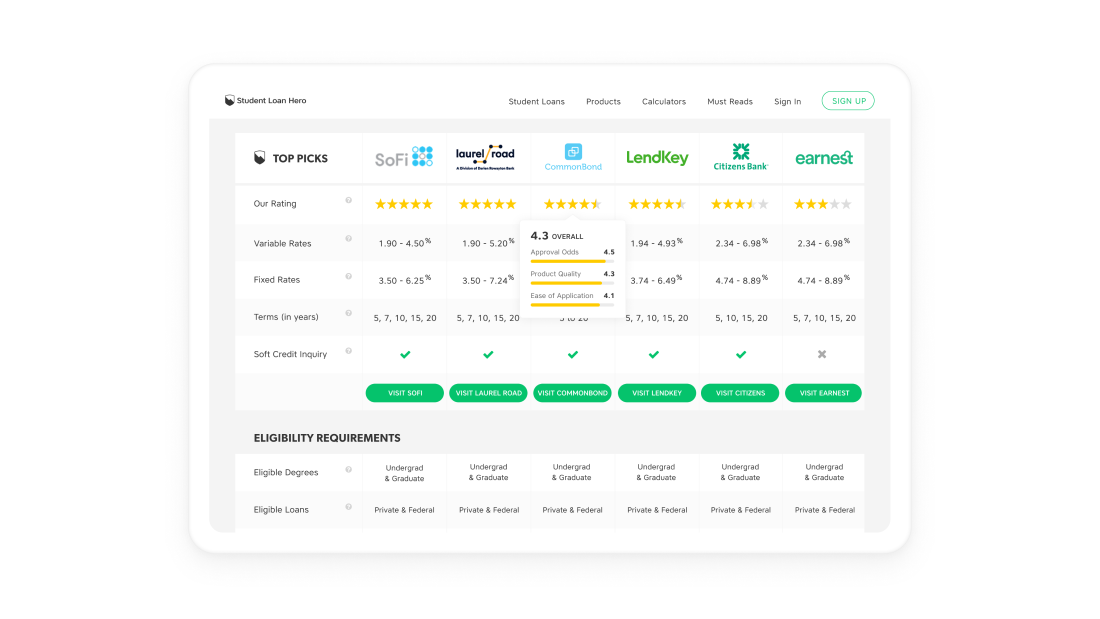

Our strategy of relentless optimization led to some remarkable results. The redesign of the blog and optimization led to the largest growth spike in company history, increasing company revenue by 25% within the first month. We not only created a dashboard for students to access information across all their loans, but we introduced a table comparing loan information. By adding it to the bottom of every blog post, we saw an immediate and lasting boost in revenue for SLH and allowed them to continue to create meaningful content for their users. Student Loan Hero leveraged these features to help hundreds of thousands of student borrowers manage and eliminate over $1 billion dollars in student loan debt. SLH provides an average of $14,000-$17,000 in savings for each user and the service is completely free. And the best part? Student Loan Hero was acquired in July 2018 by Lending Tree, America’s largest online lending marketplace!